.png)

Price-aware Planning & Forecasting

Revomo helps you forecast, align, and optimize revenue and margin by uncovering risks, opportunities, and the actions that drive profitable outcomes.

Forecast Revenue & Margins

Predict revenue and margin performance using elasticity, cost, and demand signals.

Align Plans to Targets

Reconcile forecasts with budgets and sales inputs for one financial truth.

Run What-If Scenarios

Simulate pricing strategies to stress-test cost shocks, tariffs, and competitors.

Model Profitability Drivers

Tie forecasts to market trends, churn, discounts, FX, or cost-to-serve levers.

Recover Margin Leakage

Use AI to detect revenue leakage, discount erosion, and low-margin pockets.

Detect Margin Risks

Get alerts on erosion, shortfalls, or forecast deviations before impact.

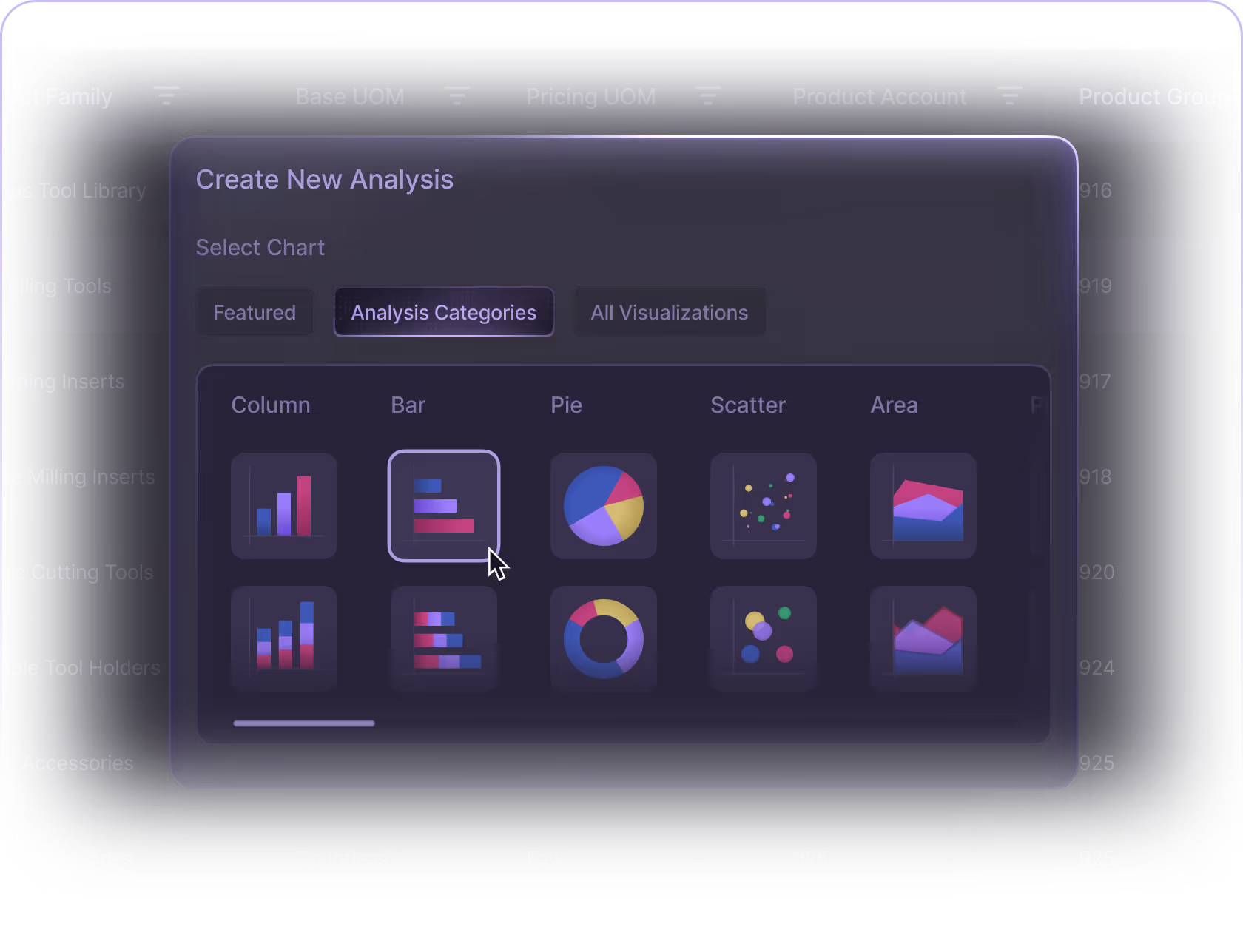

Visualize Profitability Decisions

Use dashboards to surface revenue gaps, leakage, and pricing opportunities.

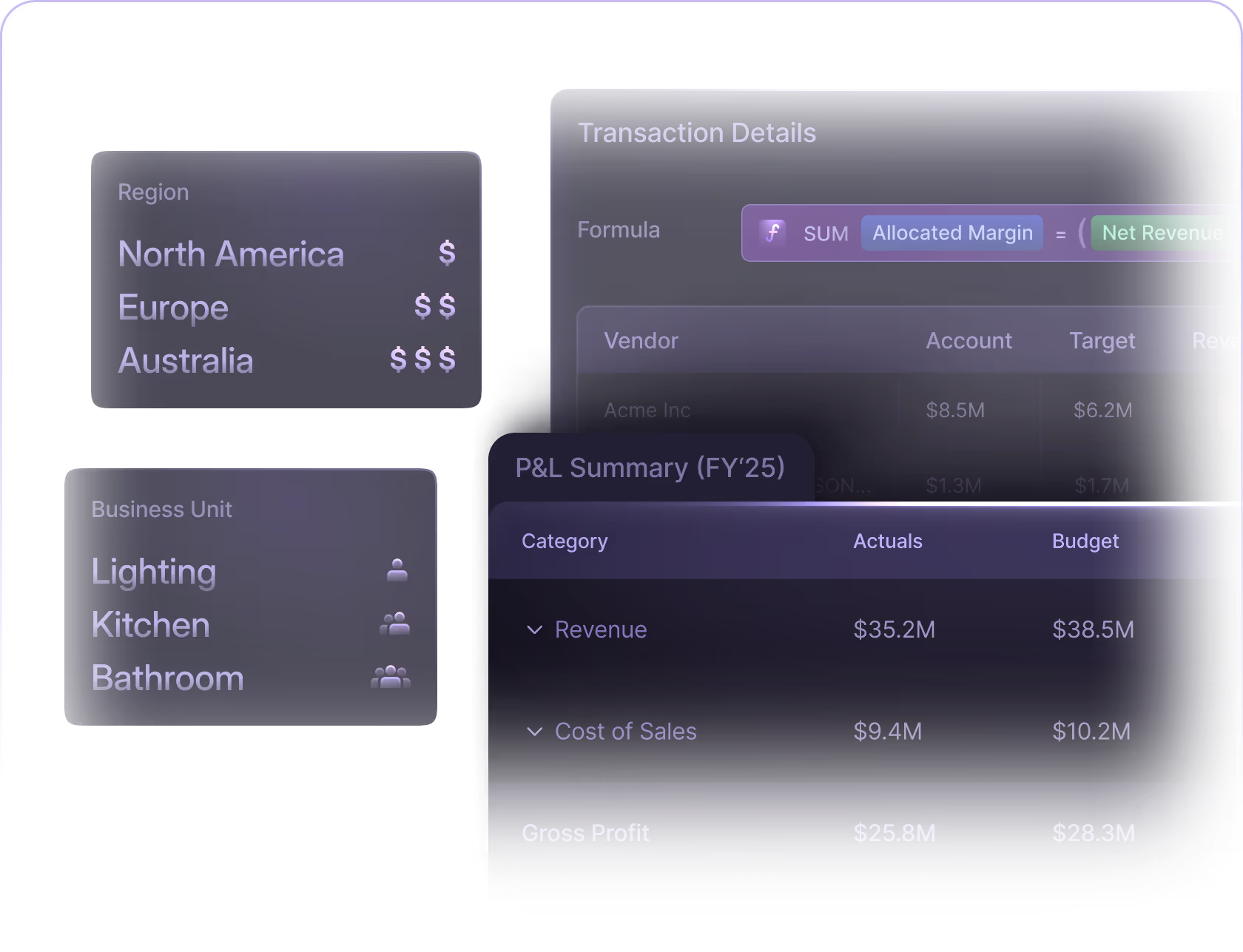

Consolidate Entity Margins

Unify sales, cost, and margins across entities with FX normalization.

Automate P&L Reporting

Generate consolidated P&Ls, variance analyses, and margin breakdowns automatically.

.png)

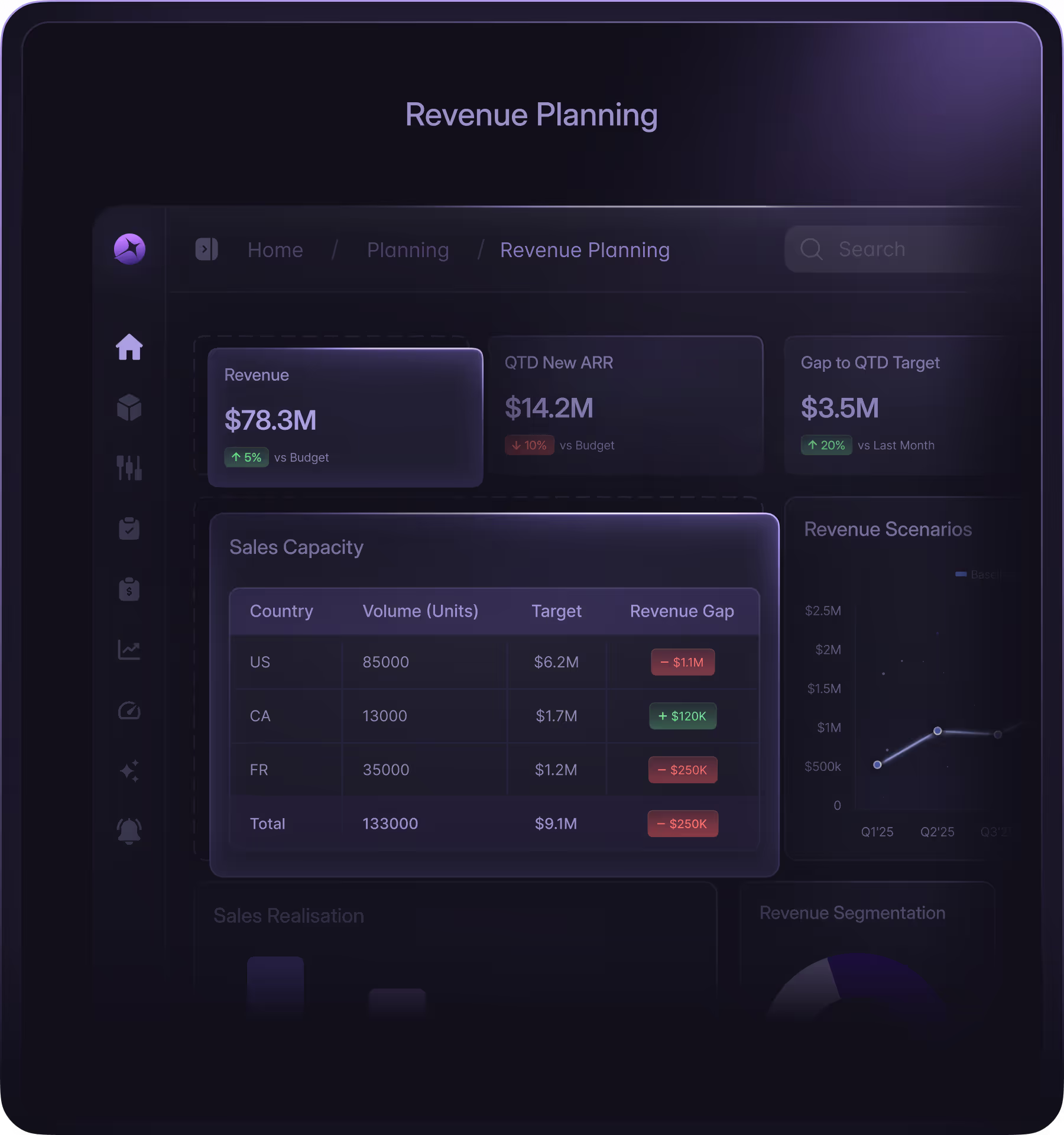

Planning & Forecasting to Anticipate and Align

Build accurate forecasts, align with budgets and targets, and run what-if scenarios to prepare for every market outcome.

Integrated & Collaborative Planning

Unify revenue, margin, and pricing targets into one connected plan.

Align finance, sales, and pricing teams around a single source of truth.

Cascade corporate goals down to sales capacity, discount policies, and cost assumptions.

Enable seamless collaboration with shared workspaces, approvals, and audit trails.

Revenue & Margin Forecasting

Project financial performance with accuracy as markets and pricing conditions evolve.

Update revenue and margin outlooks in real time as volumes, costs, or price changes occur.

Compare forecasts against actuals to quickly spot risks and deviations.

Strengthen confidence in price realization and margin capture with continuously improving projections.

Scenario Planning

Simulate alternative pricing strategies to strengthen resilience.

Compare baseline, optimistic, and pessimistic strategies side by side.

Stress-test forecasts against cost shocks, tariffs, or competitive responses.

Quantify trade-offs across revenue, margin, and volume with visual comparisons.

Financial Reporting

Bring clarity to revenue and margin performance with automated reporting.

Generate consolidated P&Ls, variance reports, and margin breakdowns without manual effort.

Drill into actuals vs. budget by product, customer, or region for granular visibility.

Automate multi-currency adjustments and inter-company consolidations to ensure accuracy across entities.

Multi-Entity Margin Consolidation

Unify multi-entity revenue and margin data with FX normalization and formula based roll-ups for clear, comparable profitability insights.

Visualization & Insights

Transform forecasts into actionable insights with real-time dashboards, profitability drill-downs, and early margin risk detection.

.png)

Predict, Align, De-Risk

Build accurate, forward-looking revenue and margin plans with pricing at the center.

Predict with Confidence

Enhance revenue and margin forecasts by integrating pricing into demand and cost signals.

Align Finance and Pricing

Reconcile top-down budgets with bottom-up execution to hit targets.

De-Risk Market Volatility

Stress-test tariffs, FX, and raw material swings before they hit the P&L.

.png)

Common Questions. Answered For You

How does Revomo forecast revenue, volume, or margin?

Revomo analyzes historical sales, cost, and pricing data to project future performance. It models demand patterns, pricing trends, and margin behavior to predict outcomes using forecasting models with measurable confidence.

.avif)

Can I model different demand or price change scenarios?

Yes. You can adjust prices, costs, or volumes and instantly see how those changes affect revenue and margin. It’s a fast way to test “what if” plans before acting.

.avif)

What algorithms or AI methods power the forecasts?

Revomo uses a mix of time-series analysis, regression models, and machine learning tuned to your data. It continuously learns from new transactions to improve accuracy over time.

.avif)

How do I compare budget, forecast, and actual performance?

Dashboards show budget, forecast, and actuals side by side. Variances are highlighted automatically so you can see which products, customers, or channels drove the gap.

.avif)

Can I forecast at multiple levels like product, region, or channel?

Yes. You can roll forecasts up to total company view or drill down to any level of product, customer, region, or channel for precise planning.

.avif)

How does Revomo handle seasonality or macroeconomic factors?

It automatically detects seasonal trends and can factor in external data such as inflation or demand shifts. This keeps projections realistic and responsive.

.avif)

What assumptions and drivers can be adjusted by the user?

You can fine-tune drivers like price elasticity, growth rate, or cost changes. Revomo instantly recalculates forecasts so teams can compare scenarios side by side.

.avif)

Can forecasts feed back into pricing strategy or AI recommendations?

Yes. Forecast results flow into Revomo’s optimization and simulation modules, where AI uses them to recommend prices and strategies that hit your profit and volume targets.

.avif)

How accurate are the models, and how is accuracy tracked?

Model accuracy is tracked continuously against real outcomes. You can view error rates, confidence intervals, and trend deviations to trust or tune your forecasts.

.avif)

How does forecasting align finance, pricing, and sales teams?

Everyone works from the same live forecast. Finance sees the numbers, pricing sees the levers, and sales sees the targets—so all decisions move toward shared revenue and margin goals.

.avif)

Can I view a P&L by customer to support deal negotiations?

Yes. Revomo shows full profit and loss views by customer, including revenue, cost, discounts, and margin. You can see which accounts drive profit and use that data to negotiate stronger deals.

.avif)

How can Revomo help manage large or complex customer deals?

Revomo centralizes pricing, cost, and margin details for every deal. It helps you model different scenarios, compare terms, and ensure each bid meets target profitability before approval.

.avif)

The Future of Pricing, Today!

From possibility to reality in days, not months or years!